Now that society is recovering from COVID-19, it is a poignant time to reflect on how it has affected consumer needs in the finance industry.

With rampant job loss and economic uncertainty, the way people engage with financial advice has changed, so the way advisers provide it must also adapt.

The economic effects of COVID-19

There are two ways COVID-19 affected people economically that are of most relevance to the financial advising industry.

People lost jobs

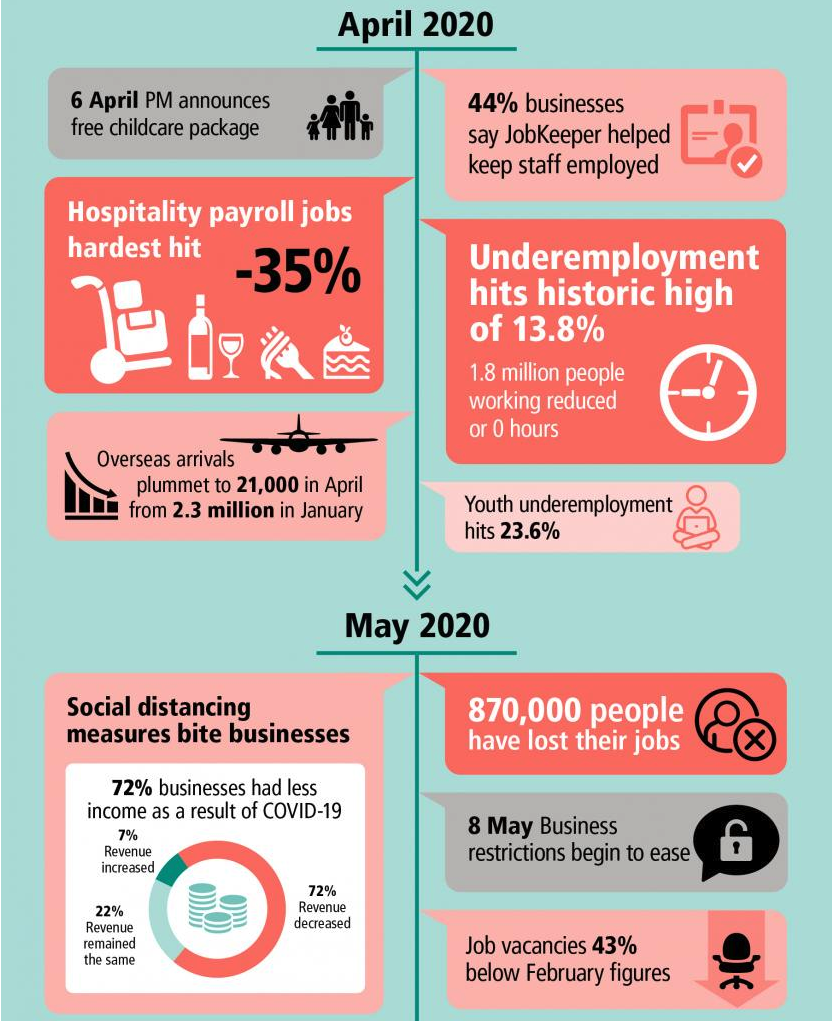

The most obvious impact of the pandemic was the historic high rate of job loss and reduced employment. In April and May of 2020, national underemployment hit 13.8%, with 1.8 million people losing most or all of their hours. Youth unemployment specifically reached a staggering 23.6%. By the end of May, 870,000 Australians had lost their jobs.

You might be wondering how this unpleasant reminder of 2020 relates to financial advising?

Unlike other economic crises, the way COVID-19 affected industries was unpredictable and unprecedented. The jobs being lost were often high-paying, ‘safe’ jobs. For example, the almost overnight suspension of the tourism industry and international travel saw pilots suddenly become redundant.

This meant that a large number of people from high-paying jobs, potentially with very complex financial portfolios, were suddenly in need of emergency financial advice.

People saved money

In contrast to people and businesses losing money, for those who maintained a consistent income, the pandemic was potentially beneficial.

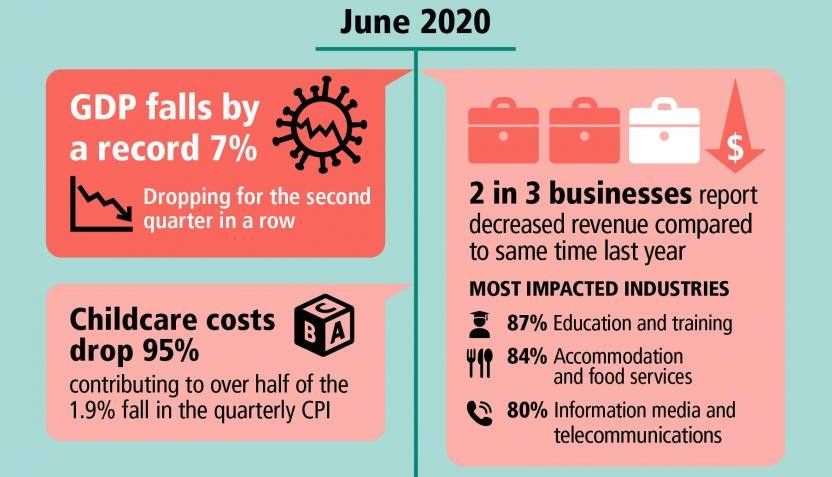

By June of 2020, the Australian Gross Domestic Product (GDP) had fallen by a record 7%. Two thirds of businesses were experiencing decreasing revenue. The hospitality industry, including food and accommodation services, was among the most impacted. Even a year later after the second lockdown in May 2021, the pandemic had cost the economy $28 billion.

A study, published in March 2022, broke down consumption habits throughout the pandemic. It revealed that outdoor activities, including dining out, transport costs and gambling had all decreased significantly by June 2020. On the other hand, furniture and appliance sales were 15% higher.

This signifies that for those who maintained a reliable income, their priorities shifted from frivolous spending to focusing on utility expenses with a long-term value.

Interpretations of the economic effects of COVID-19

The two archetypal COVID-19 experiences – people who lost work and people who saved money – have led to two forms of post-pandemic clients that need new modelling strategies to meet their needs.

People recovering from short-term ‘emergency’ advice

For those who lost their jobs, or experienced reduced hours, a rapid response was paramount to their financial security. Many liquidated investments and assets to support themselves, and are now looking to rebuild.

People looking to make the most of newfound wealth

For those who kept their income, and capitalised on reduced spending opportunities by saving or buying assets, they are finding themselves in a position to plan for their financial future.

The problem is, while they were fortunate through the pandemic, they know that many people weren’t and they are concerned about the possibility of future pandemics. The key here is easing their concerns and persuading them that you are equipped to handle any future complications.

What do they have in common?

While their circumstances are different, both examples share a common fear. The pandemic came out of nowhere and affected their financial prosperity, and even though it has subsided, they are now wary of other phenomena that could affect their future outlook.

Pre-COVID-19, financial models could take parameters like inflation and legislation changes into account, but none could foresee an unprecedented global pandemic with extensive economic consequences.

Unfortunately, you can’t build assumptions for things that haven’t happened – so you can’t promise your clients that you will foresee the next global crisis. However, you can ensure that your modelling is prepared to adapt to sudden condition changes.

Advice needs to be efficient

The first key element of a versatile modelling process is efficiency. For clients facing a dire situation like job loss, they need a fast, actionable solution. This means you need to create models and strategies quickly – and they need to be accurate.

Unlike a long-term investment plan which can be tweaked over decades, a response to a sudden change in prosperity needs to be immediately effective.

One of the biggest factors in long turnaround times is admin and compliance work. If preparing documents and researching legislation is slowing you down, you need to find a way to streamline these processes and focus on what most benefits your client.

Advice needs to be flexible

For your strategies to be effective, you need to compare models to find the most optimal ones. The problem is, you can’t compare models that factor in something like a pandemic if you don’t know when, or if, it will happen.

What you can do is make sure that your models are easily adjustable, and that you can model several scenarios simultaneously. This will give you the confidence and capability to respond to unforeseen changes.

So how can you streamline these processes to make your models more efficient and flexible?

The answer is financial modelling software.

Optimo Pathfinder

Optimo Pathfinder is a financial modelling software designed to help you model quickly and accurately, while also offering time saving benefits that can help you in other areas of your service. Just a few of its modelling features include:

- Compare and contrast multiple models simultaneously

- Create a basic cash flow scenario as a baseline to understand your client’s initial cash flow position and check the information they provided

- Easily explore and compare the projected outcomes of different goals and investment classes

- Create feasible strategies take best advantage of government benefits and legislation

- Comparing your advice to the baseline to showcase its value

- Easily alter and recalculate strategies to reflect changing client requirements

It also has other time-saving features such as:

- Simply produce strategies that comply with legislation and other tax rules

- Gain access to regularly updated legislation information at the click of a button

- Generate charts and summaries automatically

- Your charts and reports will be in plain, easily comprehensible English

- Producing detailed reports to back up the calculations

- Offering out-of-the box templates for client documents with easily imputed detail

With all of these features at your disposal, Optimo Pathfinder will make your modelling more efficient and more flexible. Have the confidence to provide quality advice to your clients, no matter what unforeseen circumstances befall them.

For more information about Optimo Pathfinder, visit our website.

Or, proceed with a free trial and give your clients the confidence to plan for the future.

Resources

AMPCapital assessment of the 2021 COVID economy: https://www.ampcapital.com/au/en/insights-hub/articles/2021/september/the-effect-of-covid-19-on-the-australian-economy-so-far

Australian Bureau of Statistics (ABS) data on 2020 economy and job loss during the pandemic: https://www.abs.gov.au/articles/one-year-covid-19-aussie-jobs-business-and-economy

2022 study detailing household consumption during the pandemic: https://www.rba.gov.au/publications/bulletin/2022/mar/tracking-consumption-during-the-covid-19-pandemic.html

Overview of future relevance and direction of financial services following the pandemic: https://www.unisa.edu.au/connect/unisabusiness/16/keeping-balance-the-rise-of-financial-advice-and-services-during-covid-19/