Optimisation

Enhance your strategy creation with the ultimate optimisation software

Pathfinder’s original optimisation engines calculate the right path towards your clients’ maximum net wealth

The Benefits of Optimising with Pathfinder

The goal of any financial advisor is to provide the best possible strategy for their clients. Frustratingly, the tool to do this hasn’t existed - until Pathfinder. With a unique fusion of comprehensive modelling and maximum net wealth optimisation, you can give your clients optimal projected advice.

Pathfinder has 9 optimisation capabilities that all work together comprehensively in a single, powerful engine.

This means that for all items in your case, you can choose specific options or let Pathfinder calculate it for you, and it will strike the right balance and build a feasible strategy. You decide how much of the plan is assisted by Pathfinder.

The 9 Optimisation Capabilities of the Pathfinder Engine

Homes and Investment Properties

Keep, buy or sell homes and investment properties. Set an exact sale year, a range of possible sale years or let Pathfinder calculate the optimal time.

Cash Accounts and Offset Accounts

Keep a cash reserve in cash or offset accounts. Automatically withdraw funds from an offset account so it doesn’t exceed the loan balance.

Secured and Unsecured loans

Let Pathfinder calculate the repayment schedule to meet a specific date, or let it calculate extra repayments depending on surplus cash and other goals.

Super funds and SMSFs

Model super funds with multiple investment options, and SMSFs with cash, shares/managed funds, fixed interest, properties with loans.

Super contributions

Optimise concessional contributions (including bring forward unused concessional cap) and non-concessional contributions (including bring-forward rule, government co-contribution, spouse super contributions), spouse super splitting.

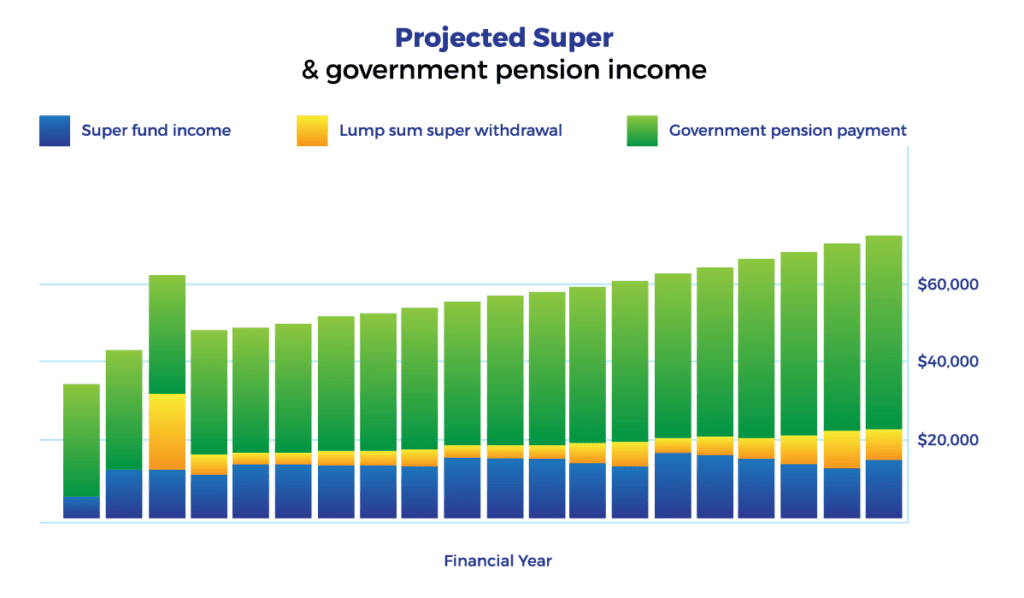

Income in retirement

Model transition-to-retirement income streams and account-based pensions from super funds and SMSFs, annuities from super money and include an estimate for the Age Pension.

Comprehensive tax modelling

Maximise projected net wealth by using tax-effective strategies such as tax offsets and paying off non-deductible loans first. Comprehensive tax reporting is included.

Dynamic cash flow modelling

Easily change income and expenses year-by-year. Automatically allocate surplus cash, withdraw funds to meet expenses and make deposits to save up for future expenses.

More items

Pathfinder can also model shares/managed funds, Insurance bonds, Life insurance premiums, HELP debts, FTB parts A and B, and more. See our full list of modelling options here.

Common Strategies

When you decide to optimise Pathfinder will often use strategies that are widely practised in the industry, such as:

- Prioritising Super to take advantage of the tax breaks, including depositing up to the cap when feasible

- Never contributing to Super if the client needs the funds before they can withdraw them

- Depositing funds into an asset with a higher return rather than a lower one

- Directing surplus cash to pay off loans with the highest interest rate first, and preferring to make repayments on non-deductible loans over deductible ones

- Starting an account-based pension and rolling over the funds required to draw a minimum pension to meet expenses

- Work out the schedule of repayments, including potential additional payments, to pay off a loan by a particular year

- Keep a cash reserve in offset accounts on loans with higher interest rates instead of cash accounts with lower interest rates

Advanced Strategies

Pathfinder can also use uncommon strategies if they suit your client’s circumstances more than the status quo.

This helps you find the right path for your client, even if it is unconventional. Remember, you always have the power to overrule these suggestions. They include:

- Keeping funds in the accumulation phase despite the individual being eligible roll over to the tax-free pension phase; in instances where the tax-free pension isn’t the optimal option

- Make a spouse super contribution if the individual is eligible

- Automatically withdrawing funds from an offset account, so it doesn’t exceed the loan balance and can be invested somewhere with a higher return

- Not borrowing the maximum LVR to buy a home because having a bigger deposit with lower on-going repayments can be preferable and avoid unintentional cash shortfalls

Up-to-Date Legislation

The software has relevant rules and legislation built in.

Pathfinder is quickly and continually updated with the latest legislation changes and can account for the impacts of new legislation year-on-year. All legislation changes are recorded in Pathfinder's release notes, which you can access at any time.